When Beyoncé launched her beauty line Cécred in February 2024, critics were quick to question the premise: could a global superstar known for wigs, protective styles and high-glam extensions credibly sell haircare?

Her response came not in words, but in a video of the musician parting her long, natural hair, walking viewers through her Cécred wash-day ritual. It was intimate, deliberate and effective. The message was direct, dispelling the myth that those who wear wigs don’t have long and healthy hair. Fans weren’t just convinced — they wanted in.

By September, Cécred had its answer: the Restoring Hair & Edge Drops, which promised fuller, thicker hair, whether thinning was due to stress, hormonal shifts or styling tension. The product quickly became a bestseller, selling out repeatedly at Ulta Beauty and on Cécred’s own website. Reddit threads and TikTok product reviews praised its performance, and word-of-mouth helped turn it, and by extension the brand, into a breakout hit. In less than a year, Cécred had found its hero.

Beauty brands launch thousands of products each year — in makeup alone, more than 2,000 SKUs debut annually, according to data from Circana — standing out in a saturated market takes more than strong formulas, sleek packaging or even a following of 300 million-plus. It requires a hero product: the one item that cuts through the noise and elevates the entire brand profile.

ADVERTISEMENT

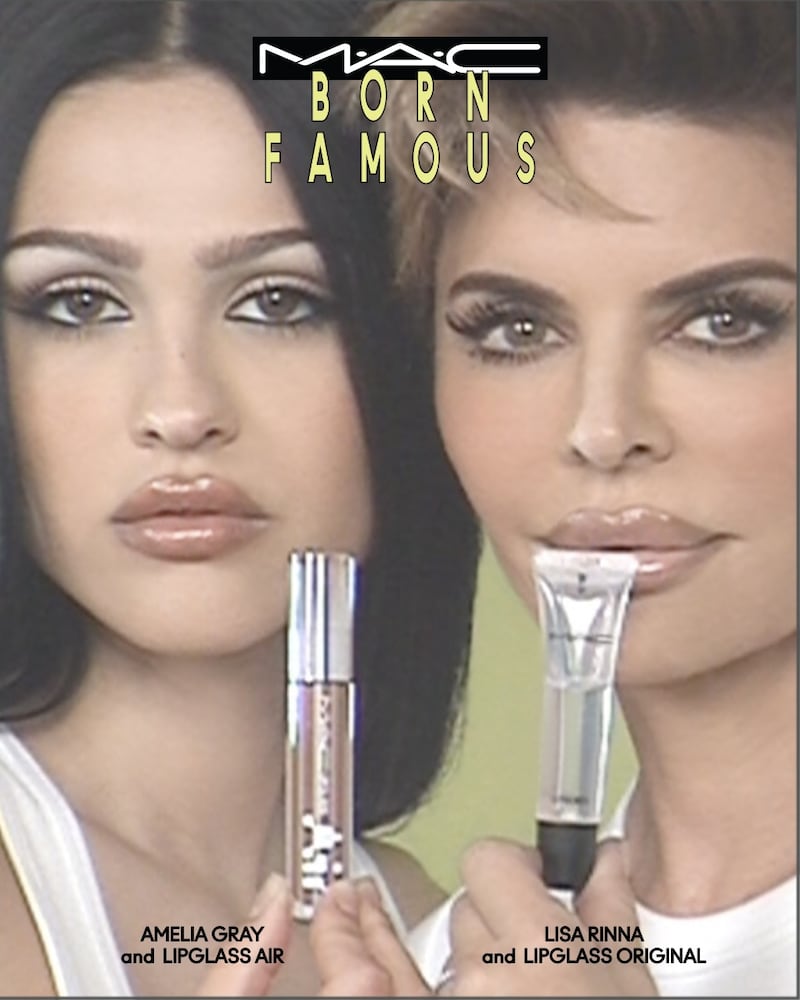

It’s a proven strategy across the industry. Legacy players like MAC Cosmetics and Clinique have long relied on hero products to build brand equity and deepen consumer loyalty. But for independent brands, often operating without the capital, infrastructure or distribution muscle of larger conglomerates, the stakes are even higher. In a tightening market, a breakthrough product isn’t just helpful, it is essential.

Identifying the right product — and knowing when to double down — is key for indie brands aiming to scale and attract new customers. A successful hero can anchor brand identity, inform product pipeline decisions and influence both retail positioning and marketing plans.

According to Sarah Lee, co-founder and co-CEO of Glow Recipe, the winning strategy is relatively simple: “Launch, sustain and build.”

Formulation First

A product can only become a hero if it works consistently, visibly and better than what’s already on the market.

That was the strategy behind Pattern Beauty’s leave-in conditioner, one of the first products to launch from the brand founded by actress Tracee Ellis Ross and incubated by the Beach House Group. From the outset, the team focused on solving two persistent pain points: delivering enough slip to detangle coily, tightly textured hair, while locking in moisture for curls that dry out more quickly.

“It wasn’t about sacrificing one for the other. The formula had to have it all,” said Tiffani Carter, Pattern Beauty’s chief marketing officer.

Today, the leave-in conditioner accounts for nearly half of the brand’s daily revenue on its direct-to-consumer site — and remains one of its highest-replenishment SKUs. A Palo Santo-scented variant launched in 2023.

For skincare label Topicals and its Faded serum, the brand set out to destigmatise chronic skin conditions like hyperpigmentation and post-inflammatory discolouration, offering results without a prescription or dermatologist visit. Wrapped in playful pink packaging, the product aimed to make the typically clinical “ointment aisle” feel more fun, said Roxana Ontiveros, Topicals’ product marketing lead.

ADVERTISEMENT

The team initially worried that Faded’s strong, sulphurous odour might alienate consumers. One Reddit user described it as “wet cat food mixed with some kind of floral perfume.” But it ended up working in their favour, as consumers began to associate the scent with efficacy.

“It coincidentally ended up being something that really gave us a lot more authority and credibility in the clinical space,” said Ontiveros.

From Hype to Habit

Initial buzz can drive early sell-outs, but long-term success depends on sustained storytelling, consistent visibility and finding new ways to engage consumers.

For skincare brand Glow Recipe, that meant continuing to invest in its hero SKU, the Watermelon Glow Niacinamide Dew Drops, even alongside new launches. It’s 2023 Dew You campaign, featured models explaining their love for Dew Drops and ran on the brand’s social platforms. Though the product was originally positioned as a brightening and glow-boosting serum, consumers began sharing their own use-cases: as a makeup primer, or mixed with other products for added shimmer.

“That drum beat over the years has helped people really understand that Dew Drops is a product to be used in a multitude of ways,” said Lee.

Pattern Beauty takes a similar approach — treating its hero product, the leave-in conditioner, like a marquee launch several times a year.

“It gets all the marketing support a new product would — new model imagery, updated product visuals, on-site programming, influencer outreach, social activities and review campaigns,” said Carter.

In summer 2023, Pattern focused an entire campaign solely on the leave-in. The key to that push, said Carter, was tapping into performance claims that immediately communicated why the product outperforms the competition.

ADVERTISEMENT

“Why should I keep coming back as an existing customer, or why, as a new customer, should I choose this product over any other?” she said. “Those are the questions we’re always answering.”

Build on the Success

Strong hero products often set the stage for what comes next.

For Glow Recipe, the way consumers used Dew Drops laid the groundwork for a broader Dew franchise, including Watermelon Glow Niacinamide Dewy Flush (a blush) and Hue Drops (a bronzer). Both products extend the original’s glow-first positioning while expanding the brand’s presence in colour cosmetics — without straying from its skincare roots.

For Topicals, iterating on Faded became essential to addressing consumer concerns, particularly around the product’s strong scent. The brand expanded into new offerings, including eye patches designed to target dark circles, which quickly became a go-to for travellers and celebrities alike. They also launched a body bar to combat hyperpigmentation. In March, Topicals re-released the Faded Serum in an odourless version to further broaden its appeal.

The label’s popular eye masks didn’t just respond to a consumer need, they also helped redefine how and where skincare is used, said Ontiveros.

“We didn’t anticipate how much the product would be taken out of the home,” she said. “But the fun branding and portability made it feel different — more accessible, more wearable. It felt like an ad for the hero itself.”